Strong trade relationship but with trade imbalances

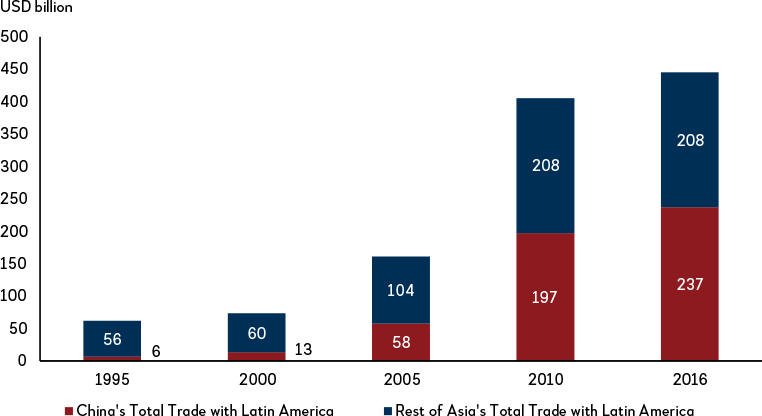

Unlike overland trade across Eurasia where the challenge is to improve accessibility for land-locked countries, the challenge for Latin America and Asia is to overcome the vast ocean distance. In terms of geography, Latin America and Asia are literally on opposite sides of the world. Nonetheless, driven by the rise of China and complementarities, Latin America and Asia’s trade has grown strongly in the past two decades, and by a factor of 7 since 1995 to reach USD465.0 billion in 2016 (Figure 3).

Brazil is the most important trade partner and part of the supply chains to Asia. From world input-output table 2014, the research estimates that Brazil sold intermediate goods worth more than USD60.0 billion, and goods for final demand worth more than USD11.0 billion, to Asia, Australia and Russia. The continued development of these economies, especially in sectors that help strengthen Asia’s supply chains, will be of significant benefit to Asia.

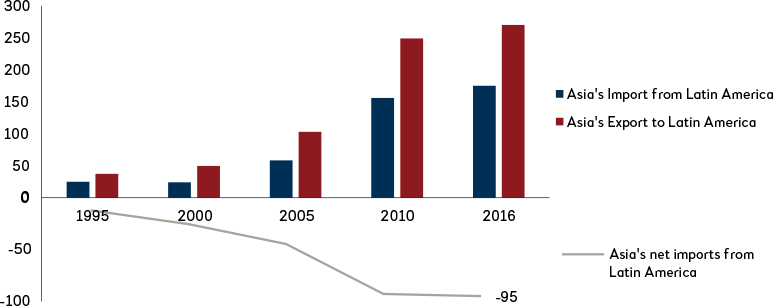

However, two imbalances stand out. First, Latin America (as a whole) has a large trade deficit with Asia, reaching USD95.0 billion in 2016 (see Figure 4).

Second, trade between Latin America and Asia is dominated by the “commodities for manufactures” trade, especially with the rise of China. Latin America’s export to Asia has remained more natural resources-oriented (which also requires larger freight component CIF) compared to Asia’s more sophisticated and diversified export basket (see Table 3).

Figure 3: China and rest of Asia’s total trade with Latin America, USD billion (1995-2016)

Source: UN Comtrade, Authors’ Calculations. Asia: Afghanistan; Australia; Bangladesh; Bhutan; Brunei; Cambodia; China; Sri Lanka; Timor-Leste; Hong Kong, China; Indonesia; Japan; Korea; Macao, China; Malaysia; Maldives; Mongolia; Myanmar; Nepal; New Zealand; Pakistan; Papua New Guinea; Philippines; India; Singapore; Vietnam and Thailand. Latin America: Argentina, Bolivia, Brazil, Chile, Colombia, Costa Rica, Cuba, Dominican Rep., Ecuador, El Salvador, Guatemala, Haiti, Honduras, Mexico, Nicaragua, Panama, Paraguay, Peru, Uruguay and Venezuela.

Figure 4: Asia and Latin America trade balance, USD billion

Source: BACI-CEPII, UN Comtrade, Authors’ Calculations.

Table 3: Latin America trade composition with Asia

Source: CEPII-BACI, Authors’ calculations.

Although such economic relationships are not inherently detrimental and reflect comparative advantages between the two regions, an improved trade balance can ensure greater sustainability. The question is whether Latin America and Asia will see a more balanced trading relationship in the coming decades.

More Industrial Exports from Latin America to Asia?

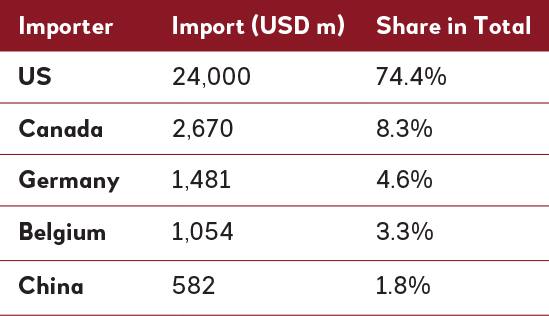

Latin America is certainly not without industrial capacity. As a comparison, Latin America has a more balanced trade pattern with the US. More than half of Latin America’s export to the US is made up of manufacturing goods including machinery and electronics (see Table 4). This also reflects the presence of many multinational firms in Latin America, producing goods and shipping them back to home or other markets, and also the effects of Mexico within NAFTA.

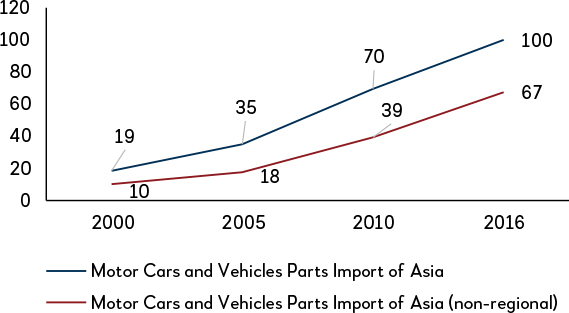

Interestingly, there are also overlaps between the export basket of Latin America and the import basket of East Asia and the Pacific. Mapping what Latin America exports with what Asia imports, one finds that there might be some industries where Latin America may be further plugged into Asia’s production and export to Asia. Two sectors could hold some promise: cars and vehicles, and medicaments. These are sectors where Latin America exports and Asia imports from outside the region. Mexico and Brazil are the world’s seventh and ninth largest producers of vehicles. An important reason behind the exports of motor cars and vehicle parts is due to Mexico and NAFTA. This underscores the importance of supply chain integration.

Table 4: Latin America trade composition with the US

Source: CEPII-BACI, Authors’ calculations.

Motor cars and vehicles parts

Table 5: Top Importers of Latin America motor cars and vehicle parts exports

Share in total refers to exports to non-Latin American countries.

Figure 5: Imports of motor cars and vehicle parts of Asia (USD billion)

Medicaments

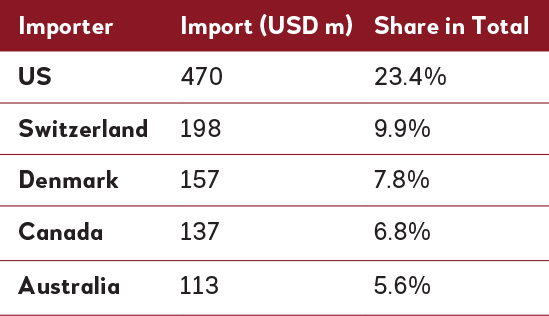

Table 6: Top importers of Latin medicament exports

Share in total refers to exports to non-Latin American countries.

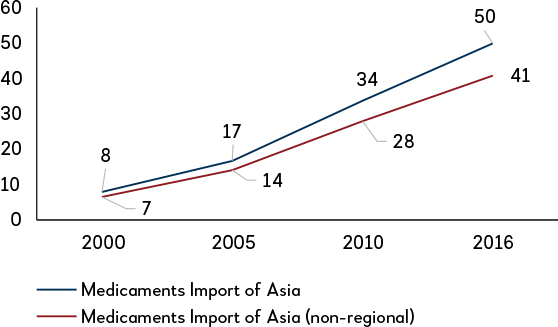

Figure 6: Imports of medicaments of Asia (USD billion)

Will greater connectivity help? Here, research suggests that economics at work are less than favorable. Based on the Shanghai Containerized Freight Index (SCFI), the container shipping cost between Asia and South America is comparable to what it costs to ship from Asia to other regions. But there is a higher volatility for the Asia-South America route, with the cost ranging from USD100 per TEU in early 2015 to around USD2,000 in mid-2018.

Industry experts cite some structural reasons that inhibit the further development of shipping. One of them is the nature of trade. For example, the lack of backhaul container demand (that is, from South America to Asia or to Africa) limits shippers incentives to add capacity. The limited capacity then feeds back into transport cost volatility. In that sense, adding port infrastructure alone would not be sufficient. It stands to reason that a more balanced trade pattern, in the long run, is needed to improve the dynamics of transport costs, which will have positive feedback on trade itself. Development connectivity infrastructure alone will not be sufficient, it has to be accompanied by investment in manufacturing sectors that are plugged into Asia’s supply chains.

Tourism links are growing fast from a small base

Tourism represents an area where there could be strong growth in the coming decades. Tourist arrivals to Latin America increased by 6.8 percent on average per year in 2005-2016, reaching 68.7 million in 2016.

On the other side of the world, China has become a leading global source of outbound travel. Total expenditure by Chinese tourists grew by 12 percent in 2016 and reached USD261.0 billion (around 135 million tourists per year). The potential of Chinese tourism to Latin America is large. Mexico was by far the most popular tourist destination for Asian tourists in 2014, with 110,000 visitors, followed by Brazil (64,000), Venezuela (34,000) and Argentina (32,000). The figures here may seem small but there is a chance that this could change dramatically with the improvement of aircraft technology and connectivity.

Air Connections: Improving Technology to Shrinking Economic Distances Between Asia and Latin America

Air connectivity, facilitating face-to-face interactions, is important in promoting economic activities. Recent cutting-edge research on direct air links continues to validate this view. Clearly, air connections are also important for international tourism flows.

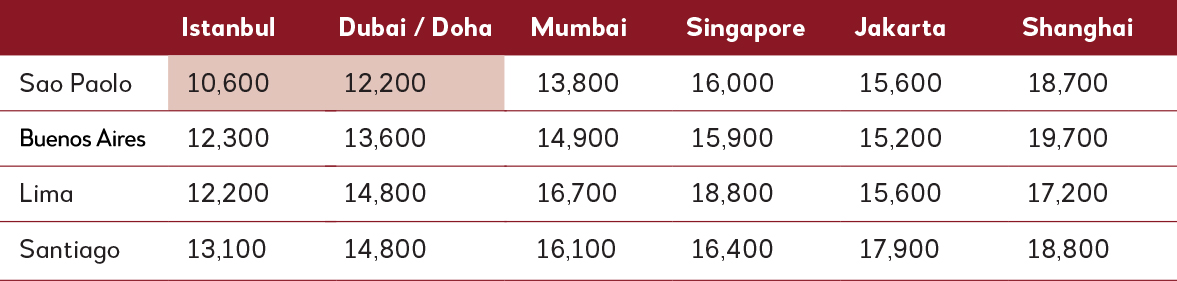

Today, only two regions in Asia have direct air links to South America (based on data from openflight.org): a direct flight from Istanbul, and some flights from the Middle East, to Sao Paolo (distances are 10,600 km and 12,200 km, respectively). From Mumbai, it is also feasible to reach Sao Paolo directly but there is currently no direct air link.

However, with improvement in aircraft technology (in particular fuel efficiency), it could become technologically and economically feasible to have more direct air links between Asia and Latin America. Today, Qantas operates a Perth-London route, covering 14,500 km, while Singapore Airlines operates the Singapore-New York route (15,300 km). It has been reported that Qantas is already planning for a Sydney-London route (17,000 km) using the next generation aircraft. These distances are comparable to what is required to link major Asian gateways with Latin American ones.

Mumbai, with its large economy and hinterland, looks well-poised to become a “launchpad” to South America in addition to Istanbul and the Middle East. At a stretch, it could also be possible to have direct connections between Singapore and Jakarta to some Latin American cities.

Table 7: Geodistances between Asian and Latin American gateways (km)

Note: Colored cells indicate the presence of a direct air link.

It is also interesting to note that unlike container traffic, air traffic is not usually constrained by the lack of backhaul demand, given the need for travelers to return to home countries. Supporting infrastructure and regulations, together with improving aircraft technology, have the potential to connect these two major regions and fundamentally alter trade and economic development.

Investments in key areas are needed

Finally, the Economist cites that Latin America lags behind East Asia, the Middle East and South Asia in terms of infrastructure spending. More than 60 percent of Latin America’s roads are unpaved, compared with 46 percent in emerging economies in Asia and 17 percent in Europe. Indeed, the research here also finds evidence that Latin America’s infrastructure quality can to some extent explain the structural trade deficits with Asia.

In the coming decades, as China develops, the impact of China as a contributor to global demand for goods and services would likely begin to outweigh its impact as a supplier. This points to a potential to broaden Latin America and Asia’s economic relationships beyond today’s patterns of trade. Policy efforts are needed to improve Latin America’s infrastructure to allow for more industry clusters to develop and integrate with Asia, in order to ensure this successful outcome.

AIIB, with its mandate to finance the development of infrastructure as well as productive sectors, can partner with Latin America toward the deepening of mutually beneficial economic relationships.