Solar photovoltaic (PV) technology is emerging as a key component of China's strategy to bridge its electricity gap and achieve its “dual carbon” goals, according to a new AIIB report and forecasts from energy agencies and academic institutions. The efficiency and cost-effectiveness of solar PV are key factors in its rising prominence, with projections indicating its share in China's electricity mix will increase from 5% in 2022 to 45% by 2060.

That could help China achieve its dual carbon goals, established at the 75th UN General Assembly in 2020. Aimed at achieving peak carbon emissions by 2030, and carbon neutrality by 2060, the goals necessitate an overhaul of the energy sector, responsible for nearly 90% of China's greenhouse gas emissions.

Transitioning from a fossil fuel-dependent system to one that is distributed, market-driven and environmentally friendly will be essential for this transformation. It will require an extensive expansion not only in solar PV but in other types of renewable energy, such as wind and hydropower, which in all are projected to account for up to 80% of power generation by 2060. As China seeks to revolutionize its energy sector, it will also need to explore additional power resources to bridge the prevalent electricity gap.

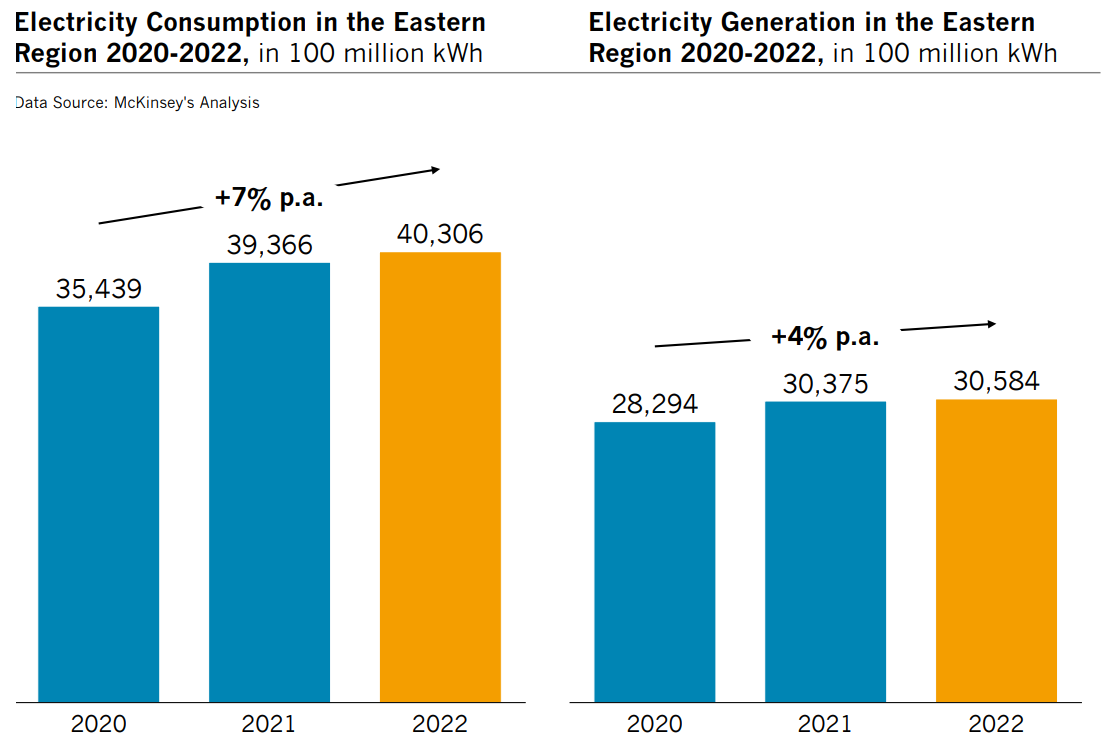

In China's eastern region, the urgent electricity deficit is evident. As of 2022, the annual electricity demand exceeded 4 trillion kilowatt hours (kWh), far surpassing the generation capacity of about 3 trillion kWh, leading to a shortfall of roughly 1 trillion kWh. This gap, expected to widen annually, highlights the need for enhanced power generation. The region has witnessed electricity demand rise by about 7% annually since 2020, outstripping the 4% growth in power generation, emphasizing the necessity of additional power resources to meet the demands of ongoing economic and demographic growth.

Figure 1: Electricity Demand in China’s Eastern Region Surpasses Generation

Source: McKinsey.

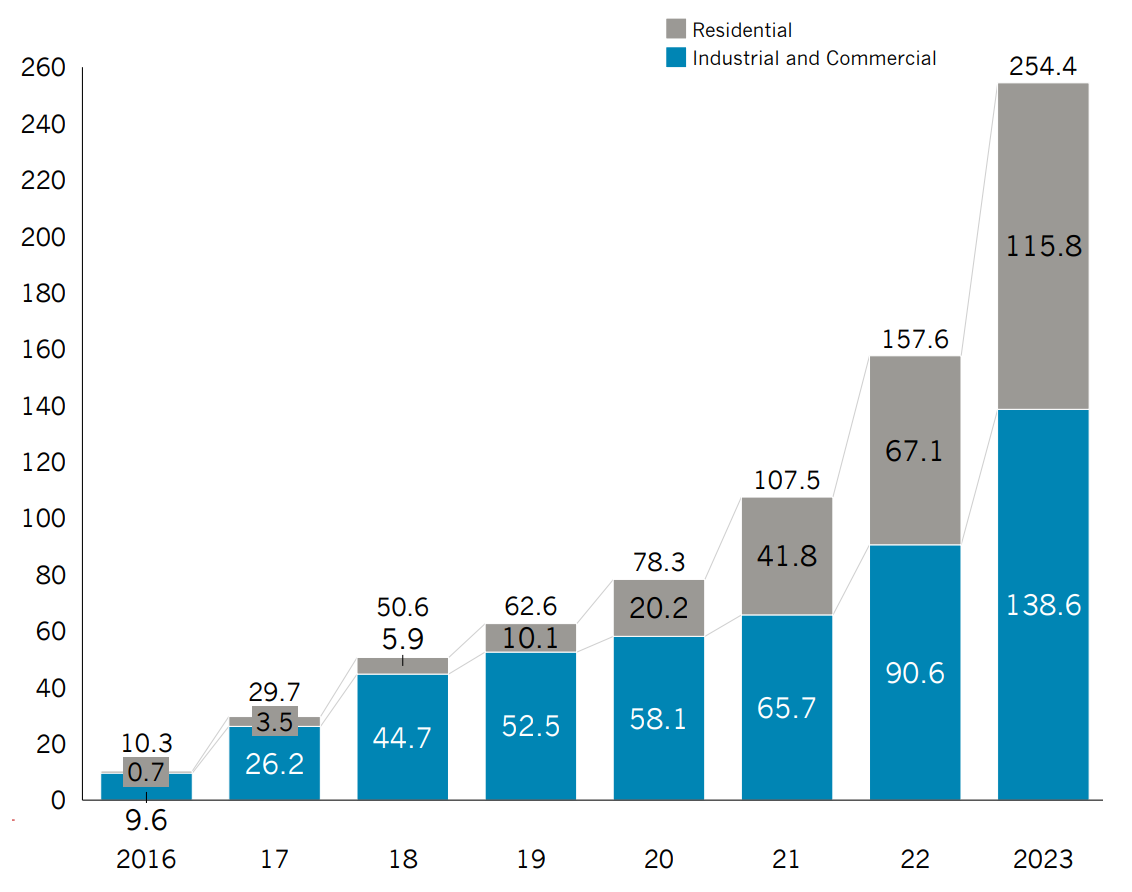

Distributed rooftop solar, offering several advantages over large-scale ground-mounted facilities, is increasingly preferred. These installations, accounting for 58% of new PV installations in 2022, are favored due to lower investment requirements, reduced construction costs and greater flexibility. These systems are smaller in scale, offering more flexibility in construction and the ability to generate power close to where it is consumed, thereby optimizing on-site electricity use. Furthermore, the abundance of rooftop space in China's rural areas, coupled with well-defined ownership rights, makes these regions particularly suitable for the expansion of distributed PV. This is especially relevant in densely populated eastern regions, where efficient use of space is crucial.

Figure 2: 2016-2023 Total Distributed Photovoltaics (PV) Capacity Installed in China (in GW)

GW = gigawatt

Source: National Energy Administration, McKinsey

The expansive rooftop area of rural buildings in China, estimated at 27.3 billion square meters,[1] presents a vast potential for residential PV installation. This could translate to an installed capacity of nearly 2 billion kW and an annual electricity generation surpassing 2.5 trillion kWh,[2] exceeding the electricity shortfall of 1 trillion kWh.

The substantial potential of rooftop solar can meet the current annual electricity demands of rural households, and can also address the wider electricity needs of sectors such as agriculture and forestry, collectively amounting to approximately 550 billion kWh. Furthermore, rural residential PV is not just environmentally beneficial, it also offers substantial commercial advantages, aligning with China’s rural revitalization strategy.

This sector has attracted a diverse range of investors, from private equity funds to large state-owned energy firms, promising a stable annual return on investment (ROI) of 8% to 10%. Moreover, the establishment and maintenance of these PV stations are creating employment in rural areas, ranging from basic installation and cleaning to more specialized roles in sales and regular maintenance, thereby contributing to local economic growth and sustainability.

To capitalize on this potential, the residential PV sector in China operates primarily under two business models: rooftop leasing and self-financing and self-ownership.

The rooftop leasing model, encompassing over 80% of the market, is particularly prevalent in rural areas and is characterized by its unique approach to customer acquisition and grid integration. This model involves developers leveraging local market insights and customer access to secure a rural customer base. They often use innovative grid integration solutions, such as "village-level aggregation," and explore green credit models, taking advantage of national incentives for green finance.

On the other hand, the self-financing and self-ownership model, where the rooftop owner bears the cost and retains ownership, is gaining traction among households aware of PV benefits and revenue potential. This model can yield a higher internal ROI (13%-15%), but it exposes owners to risks like natural disasters and operational challenges, and there is a general lack of awareness regarding insurance products in rural China. This explains the increasing preference for the rooftop leasing model in the current context.

Empowering Rural Futures through AIIB & EFC's Solar Energy Initiative

The AIIB and the Energy Foundation China (EFC) share the same vision on the critical roles that the sustainable development of distributed solar energy can contribute to the synergy of China’s energy transformation and local economy development.

Within its Green Infrastructure thematic priority, AIIB emphasizes investments in green infrastructure to combat climate change and environmental challenges. The evolving climate landscape necessitates a shift towards climate-resilient infrastructure to meet the emission reduction objectives stipulated by the Paris Agreement. AIIB commits to ambitious climate financing, targeting over 50% of its financing to climate-related projects by 2025, with significant investments anticipated by 2030. In pursuing these objectives, AIIB champions investments in rooftop solar power generation as a subset of the broader renewable energy infrastructures, recognizing it as a sustainable, innovative and connectivity-focused solution for future energy needs.

AIIB approved in February 2023 a green loan facility for Chongho Bridge, an integrated rural service provider in China, with approved financing of USD50 million to finance the deployment of rooftop solar power generation in rural regions. The investment underscores AIIB's commitment to enhancing the penetration of rooftop solar power generation in rural China and contributing to rural revitalization efforts. Targeting investments in the rural areas of Liaoning and Tianjin, this initiative marks AIIB’s first financing to support residential rooftop solar development in rural China.

This is also the first AIIB project that benefited from a technical assistant grant from the EFC. A report has been prepared with the support of EFC which, provides valuable insights into the sustainable development of the rooftop solar market in rural China, and solid technical foundation of the Chongbo Bridge green loan.

The provider Chongho Bridge originated from a microfinance poverty alleviation sub-project of the World Bank in 1996. With over two decades in the rural market, it has evolved from a microfinance service model tailored for retail rural clients, while establishing a comprehensive offline service network in the countryside, supported by a dedicated front-line team exceeding 7,000 individuals.

Dongwen Liu, CEO of Chongho Bridge, noted that rooftop solar projects could boost the annual cash income of rural populations by 10%-20%. The collaboration with Chongho Bridge is anticipated to yield significant environmental and social benefits for rural households, businesses and their wider communities through rooftop solar power generation. AIIB is committed to collaborating with Chongho Bridge to address the unmet needs of rural areas and communities in China.

[1] Source: Tsinghua University’s Building Energy Research Center in collaboration with the National Remote Sensing Center of China

[2] Source: Academician Jiang Yi, Carbon Emission Peak and Carbon Neutrality for China’s Buildings, Public Forum of the 17th Tsinghua University Building Energy Conservation Academic Week