In the complex world of international development, the gap between a brilliant idea and a bankable project can be significant. Meet the Asian Infrastructure Investment Bank's Project Preparation Special Fund (PPSF) – an innovative instrument that is set to quietly revolutionize infrastructure development across Asia.

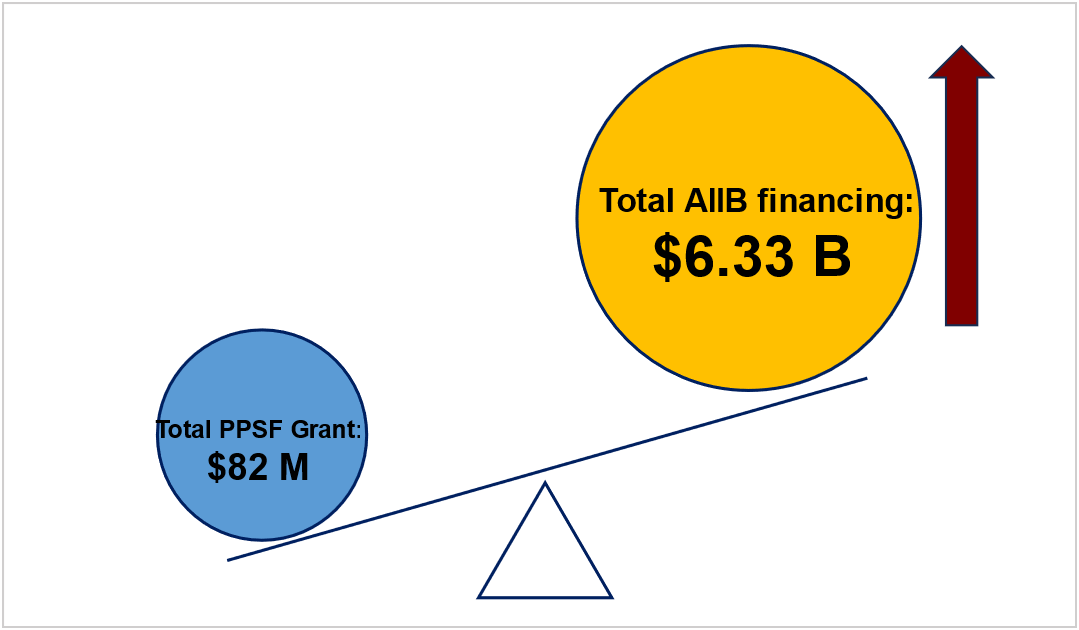

Since its launch in 2016, the PPSF has been a key driver behind some of AIIB's most impactful projects. With a funding pool of USD128 million contributed by the United Kingdom, China, Korea and Hong Kong, China, this mechanism has approved 30 grants totaling USD82 million. But the true measure of its success lies not in the numbers but in the transformative projects it has set in motion and the lives it has improved.

The impact is most profoundly felt in AIIB's Less Developed Members. By providing crucial support to eight IDA-eligible regional members, the fund has elevated countries like Bangladesh, Cambodia and Uzbekistan into AIIB's top-10 borrowers list.

This does not take just money, but also overcoming bureaucratic and technical challenges to make vital projects a reality. For example, in Cambodia, the PPSF is enhancing rural resilience by improving irrigation systems and promoting sustainable agriculture practices, helping the country adapt to climate change.

Meanwhile, the integrated solid waste management improvement project in Bangladesh, supported by the PPSF, serves as a scalable model for similar global contexts. This project not only addresses pressing environmental and public health issues but also sets the stage for future investments in sustainable waste management practices.

A Catalyst for Green Growth

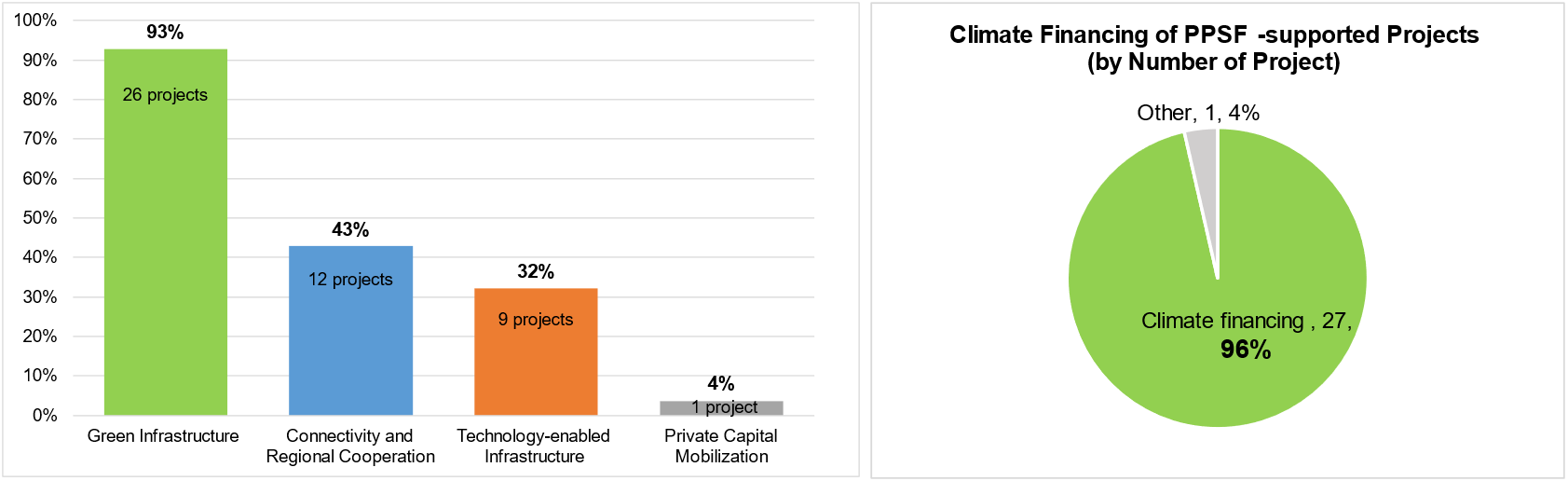

In an era where climate action is paramount, the PPSF stands out. An impressive 93% of PPSF-supported projects contribute to green infrastructure, with 27 of 28 projects featuring climate financing components. This strategic focus isn't just good for the planet – it's propelling AIIB towards (and even beyond) its ambitious goal of 50% climate finance share by 2025.

Besides individual projects, the PPSF plays a crucial role in advancing AIIB's Corporate Strategy. As of March 2024, PPSF grants align strongly with AIIB's four thematic priorities: 93% support green infrastructure, 43% enhance connectivity and regional cooperation, and 32% promote technology-enabled infrastructure.

This strategic distribution not only supports the climate finance goal but also contributes to the target of achieving a 25%-30% share for cross-border connectivity projects by 2023.

Figure 1: Thematic Priorities Alignment and Climate Financing of PPSF supported AIIB Projects

(By Number of Projects)

The true value of the PPSF lies in its ability to transform abstract ideas into shovel-ready projects that meet AIIB's high standards. The fund has significantly enhanced projects' adherence to AIIB's criteria for project design, environmental and social safeguards, and overall feasibility. The impact is clear:

- 92% of approved PPSF grants supported environmental and social assessments

- 76% supported feasibility studies and/or detailed engineering designs

- 68% assisted in the development of procurement plans

- 64% contributed to project delivery strategies

This comprehensive support has led to marked improvements in project readiness and implementation efficiency. The average time from loan approval to loan signing has been reduced from four to two months. More impressively, the duration from project approval to first loan disbursement has been cut by 40%-50%. By supporting everything from environmental assessments to procurement plans, the PPSF ensures that projects not only meet AIIB's rigorous standards but also move from concept to implementation with speed and efficiency.

Every dollar of PPSF support unlocks an average of USD80 in AIIB financing. This impressive leverage ratio demonstrates the fund's ability to turn potential into progress. With USD6.33 billion in potential financing generated from PPSF-supported projects, the impact of this initiative reaches far beyond its initial scope.

Note: The leverage is calculated based on the total approved PPSF grant amount, and the (potential) AIIB financing amount of the PPSF-supported underlying projects, including approved and projects in the pipeline.

Cultivating Expertise, Sharing Success

The PPSF isn't just a funding mechanism – it's a catalyst for knowledge and expertise. AIIB conducts regular internal training and seminars, where project team leaders share invaluable insights and best practices gleaned from their hands-on experience with the Fund. This internal knowledge exchange ensures that each new project benefits from the collective wisdom of past successes.

The learning doesn't stop at AIIB's doors. The Bank shares information externally, publishing details of newly approved grants on its website and providing guidance for potential clients on how to access the PPSF. This commitment to transparency and knowledge sharing extends the Fund's impact beyond its direct financial contributions, fostering a community of informed stakeholders across Asia's development landscape.

In addition to money, the PPSF is about building capacity and sharing knowledge. Through internal training, knowledge exchange and digitalized data management, the team behind the PPSF is constantly refining its approach. The is to ensure every grant has maximum impact.

As we look to the future of Asian infrastructure, one thing is clear: the Project Preparation Special Fund isn't just preparing projects – it's preparing entire nations for a brighter, more sustainable tomorrow. By bridging the gap between vision and reality, the PPSF is demonstrating that with the right support, even the most challenging infrastructure projects can become achievable.